From 1954 to 1992, Voltas dominated the domestic AC market, with 40% share. The foreign players were less in numbers, making the game easier for this homegrown brand. Voltas, then, had to compete with players like Blue Star, Fedders Loyd and Acro. The industry was small scale and unstructured, but managed to tap lucrative profit margins. The dark clouds hit the brand in 1993 when the American AC giant Carrier entered the Indian market. Carrier launched a new range of ACs, with modern technology and distinct looks that dethroned Voltas. The situation for the company deteriorated when the Korean and Japanese brands like LG, Samsung, Electrolux, and Whirlpool entered the Indian market. With the dawning of this century, Voltas found itself at the bottom of the list. With a meagre 7% market share, it could hardly stand strong against foreign competitors.

A report published by A.T. Kearney said “The MNC brands changed the rules of the game. The LGs and Samsungs came at a time when consumers were yearning for technologically superior and smarter products. They raised the quality levels, came with a plethora of choice options, and were able to drive demand.” Besides failing to adapt to the changing market dynamics, Voltas committed another blunder, that is to neglect the retail AC segment. Voltas had been concentrating solely on the institutional market, that is the government and corporations. The foreign brands penetrated the unexplored retail segment and completely cornered Voltas. According to S.K. Java senior Vice President of Unitary Products and Business Voltas Ltd, “We made the mistake of not taking the retail AC market seriously. The MNCs had opened up this market and made deeper inroads. They were buying more shelf space, which Voltas never had.”

Voltas made serious efforts to revive its lost position. The regeneration team of Voltas tried to understand the changing market dynamics, consumer insights, business strategies, competitors, and future course of action by consulting with Tata Strategic Management Group. The resolution was made; Voltas needed to shift from an engineering sector to a marketing company. Voltas designed a Big Bang strategy which helped them revamp product portfolio, marketing techniques, brand promotions, costs etc. The main aim of Voltas was to increase volume generations, increase sales by cutting the manufacturing and product costs. Voltas did not leave any leaf unturned to increase the sales of AC in the market.

In 2001, Voltas entered in a 50/50 joint venture with American Fedders International, for producing technologically advanced and visually appealing ACs, keeping low manufacturing costs. The R&D centres of Fedders in Florida and Singapore were accessible to Voltas. It could learn about the new product variants, product promotion and launching strategies etc. New features like purification filters, ionisers, electricity-saving modes etc were incorporated in the later models of Voltas. The company became well equipped to compete with powerful foreign companies.

Between 2001 and 2004, Voltas launched above 70 ranges of products including 1.5 tonne AC, which became a staple product in the market. Voltas could become the lowest cost manufacturer in India due to its global sourcing. The components of AC like compressors and copper tube were all sourced by Fedders at a low cost. Within 2005, the price of window AC dropped by 20%, which contributed to increasing the sales of the Voltas AC. Since 2001, Voltas had focussed towards maintaining a dealer friendly policy. It ousted the non-performing dealers and rewarded the performers with credit extensions and incentives, boosting their morale.

Voltas invested 1% of the annual turnover in training the dealers and channel partners, improving dealer infrastructure and mobile vans etc. Changes were made in interacting with the customers directly, the dealers were made responsible to answer all the queries of the customers and also give them the required service. This way, Voltas could cut down the workforce from 370 to 216. The dealers and the head office were connected by SAP, and all the transactions and interactions were online and transparent.

Revamping the promotions were necessary. Voltas started promoting features like uniform cooling, air filters, electricity-saving mode. The advertisements helped to increase the household penetration, which at the time was merely 2%, hinting towards a huge scope of improvement. The campaign “ACs with Intelligence” gained momentum among the masses, celebrities like Shah Rukh Khan promoted the brand and it was an instant success. By 2006, the image of Voltas changed to “India ka AC”, and is targeted to reach the “aam admi”. Voltas invested around Rs 50 crores for brand revamping and Rs 17 crores for marketing. All these were done to increase the market share of the company and reach more and more users.

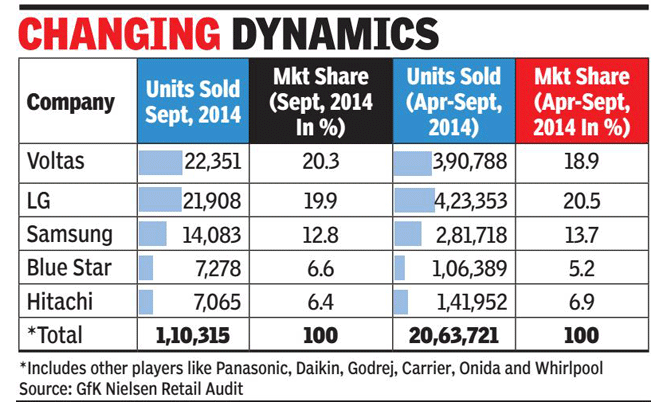

Since these reforms and techniques, Voltas has been performing well in the AC segment, especially with the exit of LG from the AC segment in 2017. During demonetization in 2016, the company had to bear the pain due to declined sales, but the situation was not that critical for this homegrown giant, which is the Tata Enterprise. Voltas plans to continue focusing on distribution, quality, and product portfolio for retaining its position in the market.

From the growth trajectory of this domestic AC segment, there is a lot to learn.

- Gain consumer insights: Voltas started focussing on in-depth market research and started understanding the demands of the consumers. The ad which portrayed a retired couple hesitant to use the AC sent by their son ultimately enjoys the cooling of the AC due to the low electricity consumption. The mantra is to show that even a retired couple with a financial constraint can use the AC conveniently. The marketing techniques, features and price brackets are determined to keep the consumers in mind.

- Be well aware of the competition: Since the liberalization, when foreign companies gained access in the Indian market, Voltas had to face difficulties. But then, keeping the technology and the retail segment in mind, it entered a joint ventured with American brand Fedders International for manufacturing components at a low cost. This way, Voltas could match the competition, maintaining the product quality at a low cost.

- Adapt to the market dynamics: Voltas did not delay in adapting to the changing market dynamics. The company accepts its mistake of neglecting the retail AC segment. But it did not take too long to change the failure into success. Voltas Vertis, All-Weather AC are some of the successful models targeted for the common man for his home.

You are hoping to expand your business, your strategies and investment options seem beneficial now, but will it be the same in future? You will look for answers on Google, but hundreds of pages of answers will not serve your purpose fully. What you need is expert guidance and advice. How will you get to talk to an Expert?

We at Vedak have an exclusive pool of experienced industry professionals and veterans who have in-depth knowledge about the business nitty-gritty. Talk to our niche skilled experts now to know the diverse competitive market in greater detail! Contact us to know more.