2020 is here and till now only 25% of the Indian population is insured. But, with the gradual penetration of insurance in the various sections of the Indian economy, it is thriving now more than ever. The step of “Make India Digital” has brought rapid changes in the Insurance Industry, and also neck-to-neck competitions. The insurance sector plays a crucial role in the wellbeing of India’s economic growth. The insurance sector has slowest growth rate in comparison to all other industries. In 2017, the overall insurance penetration was less than 4%, but as per India Brand Equity Foundation, it is expected to reach US$ 280 billion by 2020 due to increasing awareness, diverse digital and offline distribution channels and innovative and affordable products.

The insurance sector, like automotive and eCommerce sectors, is greatly affected by the waves of digitization and technological revolution. The insurance plans and policies are structured based on the needs of the modern lifestyle. Non-life insurance like car insurance, home insurance has gained unimaginable momentum. Studies show that in this decade the number of people owning personal vehicles has increased a lot.

Fluidity in the payment and withdrawal of premiums as per the convenience of the customers is a major step taken by the domestic insurance sectors. The private and government insurance sectors are thriving in the highly competitive market, giving the users a large number of options to choose from. This decade has witnessed the fast advancement of smartphones, solving the banking and the insurance needs of the users easily. This decade has seen some significant changes in the insurance sector. Let us have a look at them.

Increasing Sales and Distribution in the Insurance Industry

According to a 2019 report of Economic Times, “India’s insurance industry is improving efficiency through the use of new-age technology. Insurers have launched mobile phone apps, making it easier for customers to transact with them. They are, slowly and surely, moving towards paperless claims as well.” Both bancassurance and direct sales are blossoming in this era of modern technology. The channels of Sales and Distributions have broadened to a vast extent, thus ensuring speedy lead nurturing and lead conversions.

For example, if you want to buy insurance or even buy any product from the bank, most of the formalities, starting from document submission to document verification, can be done online. The officials are keeping all the documents in their official tablets, and this adds structure and clarity to the whole procedure. Digital Marketing is boosting the sales and distributions across all the insurance sectors. As per the report of PwC, “more than 98% of life insurance policies are still sold directly. Distribution partners will need to use technology tools to fit into a digital future, it said.”

Easier Claim Settlement Procedures

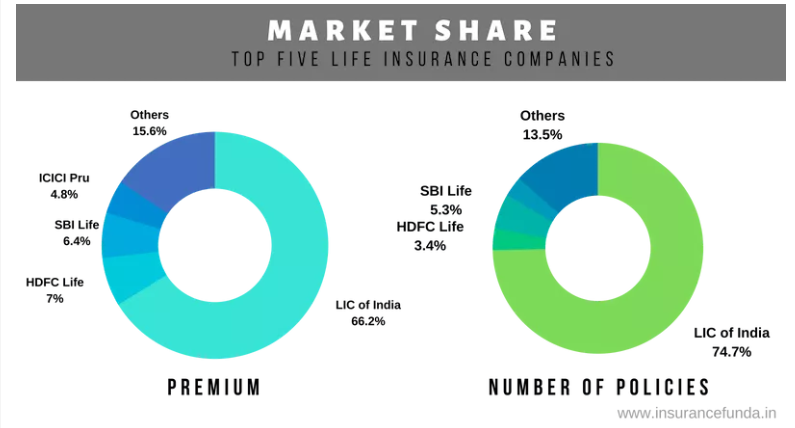

Claim Settlement is a much easier process than initial years; insurance companies are aiming towards positive customer feedback, for standing out in the competitive market landscape. The higher the Claim Settlement Ratio is, the more profitable and popular the insurance company is. In India, there are 23 private life insurance companies, out of which Max Life Insurance holds the highest Claim Settlement Ratio of 98.26%. As per IRDAI, 80% of the private insurance companies have Claim Settlement Ratio of above 90%. The competitive market landscape is accelerating the growth of insurance sectors, giving the policyholders ‘n’ number of options before selecting one.

Strict fraud management practices, data analytics, tech-enabled KYC formalities maximize the Claim Settlement Ratio. The claim sectors function in a very structured way, enabling hassle-free procedures. The insurance companies give primary importance to the convenience of policyholders.

Greater Convenience in Insurance Industry

Digitization has become an integral part of modern life. The policyholders are investing only after ample research, unlike a decade ago when these avenues were just in the imagination. Going paperless and cashless is the main mantra behind every transaction and insurance sector is not an exception. The users can check the rates in various sites like Policybazaar.com and then invest their hard-earned money. Be it applying for a new plan, withdrawing amount, or claim settlement matters, everything can be done online. The social media intervention has brought the insurance sectors closer to the user base and vice versa. They can use the online platforms for clearing doubts, and even get the reviews before any investment.

GST and Demonetization

18% GST is levied on the insurance policies, since its introduction 2017. This has adversely affected the insurance sector as the number of premiums has greatly increased. The policyholders faced difficulties in maintaining existing policies and investing in new ones. Post GST, the insurance sector has seen a decline in the sales of insurance policies due to the inflated rates. In 2016, demonetization banned two major currency notes in India which lead to a massive uproar in all the sectors of India. But as per the data released by IRDAI, to our utter amazement, the number of single premiums collected in the month of November 2016 (month of demonetization) was 507% higher than the same of November 2016.

Since the demonetization, the active usage of digital platforms has increased to a vast extent. The insurance sector was the only industry which had a positive effect due to demonetization. Since demonetization, the insurance which was growing at a rate of 28% shoot up to a rate of 40%, leaving all the other sectors at awe. The cashless push since November 2016 has turned out to be most profitable for the insurance sector.

Technological Advances in the Insurance Industry

There are several sites available online where you can compare the rates of various investment plans and insurance policies before finalizing your investment option. Technological penetration in the insurance industry has led to harmony between the policyholders, offline and online services and insurers. Blockchain technology, Internet of Things (IoT), Artificial Intelligence, Machine Learning and several other such modern innovations have made the life of modern man easier. Digitization promotes smooth connectivity between the customers and insurance sectors.

Technological intervention and the increasing interest of the common mass in the insurance sector are responsible for paving the path for future prospects. As per the report by PwC, India is embracing the technological advances as its making the whole procedure very convenient, fast and efficient. The Government of India has intervened and aimed at increasing the insurance cover with plans like Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Ayushman Bharat etc.

Winding-up

The booming employment opportunities in this decade have to lead to a significant increase in sales of automobiles, sales of flats thus boosting the growth of the insurance industry. The corporate sectors are inclined towards safeguarding the health needs of the employees by various health insurance and group mediclaim policies. In this decade, the insurance sector has had several ups and downs and one single post cannot cover the whole market landscape.

The insurance sector is directly impacting India’s economic growth. Do you want to know what else changed in this decade? Talk to our niche skilled experts now to know the diverse competitive market in greater detail! We at Vedak have an exclusive pool of experienced industry professionals and veterans who have in-depth knowledge in the banking and insurance sectors. Contact us to know more.