Since 2018, India is the second-largest producer of cement in the world with its production reaching 509 million tonnes per annum (MTPA). As recorded till September 2019 it was 163.59 MT. The top 20 cement companies have conquered 70% of the total domestic production; major manufacturing states include Andhra Pradesh, Tamil Nadu and Rajasthan. The cement production grew by 6.3% in 2018 and within one year it grew by 13.3% in the financial year (FY) 2019. This is the highest and fastest growth measured in the history of the cement industry. The government of India has focused on the infrastructural development and housing facilities of India, thus driving the cement demand.

Between the year 2000 and 2018, the Foreign Direct Investment (FDI) in manufacturing cement and gypsum products touched US$ 5.28 billion. The prospects of the cement industry in India is bright with its vast scope in housing sectors, dedicated freight corridors, ports, and other projects related to infrastructure. Since the deregulation of the cement industry in 1982, the sector has witnessed a heavy inflow of domestic and foreign investments.

To understand from an example, in recent years, Bangalore has been recognized as the Silicon Valley of India with all the multinational companies opening their Indian base in this city. The city is overly populated with tech parks, malls, multi-storied buildings, housing complexes, flyovers etc. In constructing all these, cement is the primary requirement. More and more people are coming to this city for better job opportunities and such is the scenario of other metropolitan centres as well, like Mumbai, Chennai, Delhi, Hyderabad etc. In this decade, the cement industry has been very prosperous and it underwent some other drifts as well; let us have a look at them.

Market expansion and scope of Investments in Cement Industry

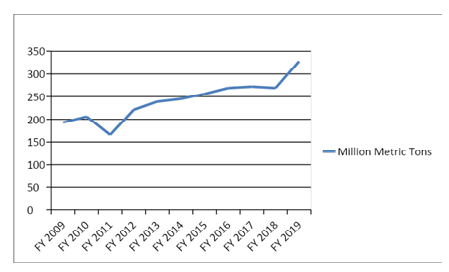

From 2009 to 2019, the volume of cement consumption in India has increased at a steady pace, as per the report published by Statista. https://www.statista.com/

From the above graph, it is evident that the increasing supply and demand is boosting the growth of the cement sector in India. Private cement manufacturing companies dominate 98% of the total cement manufacturing. The housing and real estate sectors are the major consumers of the cement, as per the recent study. The increase in per capita income of the Indian consumers is boosting the housing and real estate sectors. This is in turn positively affecting the growth of the cement industry.

The two major players of Indian cement industry ACC Ltd and Ambuja Cement are the subsidiaries of LafarageHolcim which is the world’s largest cement manufacturer hailing from France. The two Indian companies, Jaypee cement and Ultratech cement are categorized under the list of top 20 global cement manufacturers. Due to the inclusion of GST since 2017, the cement industry came under a tax bracket of 28% giving a hike to the cement price and also the rates of raw materials and crude oil. The southern parts of India witnessed the highest hike in price with Rs 77 per bag in Hyderabad, Rs 52 per bag in Bangalore and Rs 62 per bag in Chennai.

Even though there is a price hike, still the demand is also rising and the cement manufacturing companies are trying their best to meet the consumption demand. According to the vice president of Investment Information and Credit Rating Agency (ICRA), “For FY20, we expect a demand growth of eight per cent and given the limited capacity addition, this is likely to result in an improvement in the industry’s utilization to 71 per cent in FY20 from 65 per cent in FY18. Improved capacity utilization is likely to support the price uptick which has been seen since March 2019.”

Since the beginning of the decade, the cement industry in India is thriving and the cement production is estimated to make an additional growth of 20 million tonnes per annum (MTPA) by the FY2019-2021. The market has been profitable for several investment options and this decade has witnessed quite a handful. In 2010, India produced 7% of the total global cement production and it accounted for 1.3% of India’s GDP. With the rising demand generated by the commercial and industrial constructions, housing and real estate sectors, and also infrastructure, the cement consumption is estimated to reach 600 million MTPA by 2025.

In 2019, the Securities and Exchange Board of India(SEBI) approved the initial public offering (IPO) of Emami Cement. In 2018, Raysut Cement Company planned to invest US$ 700 million in India by 2022. The cement industry is structured and very active in the market, just like the insurance and automotive sectors. The cement sector is creating employment opportunities for around 2 million people in India and it also helps in boosting all other sectors, quite literally. If an office or an organization is to be created, the first thing that is needed is cement. Judging by the trends followed in this decade, the cement industry is showing great promises in recent years.

Technological Advances and Rising Competition

The technology penetration and the tide of rising competition are going hand in hand. Blockchain technology and Artificial Intelligence (AI) is keeping the cement sector well organized. The automation is aiming to reduce the human intervention to check the rates of accidents and mishaps, to enhance better management of supply chain, to keep a track record of various projects and payments etc. Technology is making the process of delivering and manufacturing fast and efficient. Newer companies are entering the market to meet the demands of the vast population of India. There are above 200 cement plants in India where technology is applied for various functions. The new-age manufacturers and consumers are taking the help of technology and aiding the growth of the sector.

Government Initiatives for Cement Industry

The government of India has started campaigns like Smart Cities Mission and Swachh Bharat Abhiyaan and it is cushioning the demand growth of the cement production. The Union Budget 2019-2020 states that “Government is expected to upgrade 1,25,000 km of road length over the next five years.” The cement plants situated near the ports like Vishakhapatnam, Gujarat and Chennai have an added advantage over the plants located in the interior regions of the country. The plant locations near the ports help in cement exportation in various other parts of the world like the Middle East, Africa and Europe.

The government is taking special concern regarding the logistical and infrastructural development of the country. The road constructions for better connectivity is also gaining momentum under the vigilance of the government. The quality of the important roads like National Highways is enhanced for improving the transportation of cement from the point of manufacturing to the point of delivery or consumption. The Indian railway facilities are expanded for easing the transportation costs, thus boosting the affordability of the cement.

Closure

The cement industry shows great prospects in recent years. The bygone decade has been very crucial for the Indian cement sector. Cement is the primary requirement for any kind of infrastructure of building any organization be it offices, tech parks, malls, schools, hospitals, colleges etc. Digitization and globalization have played a major role in boosting the cement sector, just like any other sector of the Indian industrial segments. The cement manufacturing and transportation are using the new age technology and the high disposable manpower for a successful and prospective future.

The cement sector is directly impacting India’s economic growth and in these 10 years, many things changed. Do you want to know what else changed in this decade? Talk to our niche skilled experts now to know the diverse competitive market in greater detail! We at Vedak have an exclusive pool of experienced industry professionals and veterans who have in-depth knowledge in the cement sector. Contact us to know more.