The consumer durable industry in India is thriving with the increasing demands of the vast and diverse user base of the country. This sector is expected to reach US$ 20.86 billion in 2020. And by 2025 it will be the 5th largest in the whole world. The urban and rural economy contributes to the growth of this sector, though the major share is contributed by the former. The consumer durable which includes the electronic gadgets, appliances, household items, cleaning equipment, fans etc are utilised by the urban and the semi-urban sectors. With technology penetration, they are used to some extent in rural areas as well.

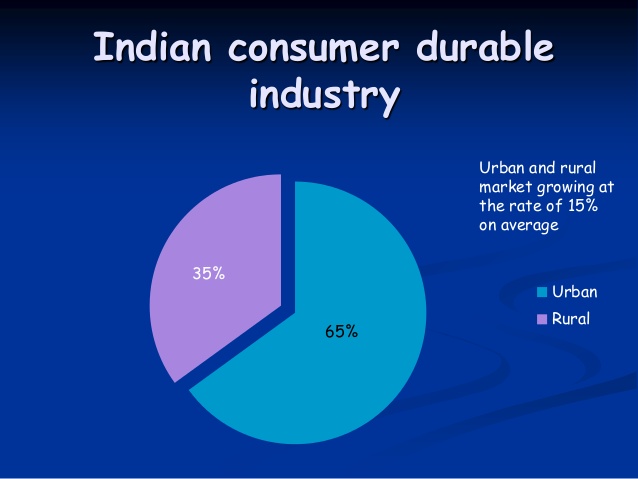

About two-third of Indian consumer durable is sold in the urban centres and major metropolitan cities. India is a tropical country with unbearable summer months, and a considerable percentage of revenue is drawn from the selling of air conditioners, fans, air coolers, refrigerators etc.

The manufacturing of the consumer durable takes place in various parts of the country, like Delhi and Uttarakhand in north, Maharashtra and Gujarat in the west, Tamil Nadu in the south and West Bengal in the east. The increase in per capita income of the people leads to the rising of the consumer durable sector in India. The consumers are very keen in elevating their lifestyle; the media explosions, the attractive marketing strategies of the manufacturing companies, peer pressure and competitive market lead to the booming fast-moving consumer durable (FMCD) industry in India.

From 2010 to 2019, the consumer durables sector has grown at a steady rate of 8-10%, marking the scope of future prospects. In this decade the sector has drifted in a different direction, let us see how.

Consumer Behaviour

The customer is king, and he can decide the fate of a company by simply shifting his preference. By the end of the decade, the consumers have been digitally influenced. During the first half of the decade, the eCommerce platforms entered the Indian economy, but it gained momentum in the second half. A recent report published by Google India and Boston Consulting Global (BCG) states that more and more people are considering the online platforms to purchase the consumer durable and by 2023 the online purchase will reach to US$ 10.4 billion. According to the partner and managing director of BCG, “when you look at e-commerce stats they significantly understate the role of digital because it is only a small percentage of people who purchase online but it is a larger percentage of people who are influenced online”.

There is a large percentage of people who visit online platforms before buying the items offline. They compare the rates, the features, they read the reviews and then they plan to invest in a particular consumer durable. More than 70% of the Indian population is hailing from the rural sector. The Government has started many campaigns and initiatives to improve the interconnectivity, the campaign of “Make India Digital”. The introduction of Jio 4G has raised the number of consumers who are investing via online platforms. The cheaper internet rates and the competitive rates of smartphones have played a positive role in boosting the sale of consumer durable.

Market Expansion of Consumer Durable Industry

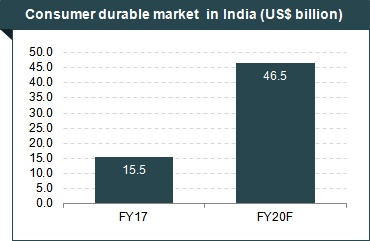

This point is the continuation of the previous one. In comparison to the beginning of the decade, the market size has increased to a great extent. The consumer durable market expanded at a rate of 11.7% and reached US$ 6.3 billion, and it is expected to reach US$ 48.3 billion by 2022. The consumer durable industry is broadly classified into two sectors. First, one being white goods which include air conditioner, refrigerator, washing machine, sewing machine, fans, cleaning equipment, microwave ovens and other domestic appliances. The second one is the brown goods which include television, audio-video systems, CD/DVD players, camcorders, cameras, laptops, desktops, and other electronic accessories.

With the new age technological advances, the sale in both these sectors has gone up. New electronics like Alexa is there for your audio assistance. In the financial year (FY) 2018, the import of electronic goods reached US$ 53 billion. Since the beginning of the decade, many foreign companies are entering the Indian market and trying to gain the attention of the huge domestic user base. Companies like Micromax entered the market but could not retain the position for long. Since 2016 the company Xiaomi entered the market and till now enjoying the limelight.

The appliance and consumer electronics (ACE) market are growing at a steady pace in recent years. It is expected to reach US$ 400 billion by 2020. The decade has been very favourable for the consumer durable market and it holds great prospects in the near future as well.

Government Initiative for Consumer Durable Industry

The Indian Government is taking several initiatives to augment the growth of the consumer durable sector. In 2019, the Ministry of Electronics and Information Technology passed the National Policy on Electronics Policy. A new Consumer Protection Bill was passed to make the existing rules more effective. The Foreign Direct Investment (FDI) into single-brand retail has increased from 51% to 100% thus encouraging the foreign brands to reach the domestic users. The key players dominating the market are Samsung, Whirlpool, Voltas, LG, Hitachi, Haier, Godrej, Blue star, Bajaj etc.

The government has encouraged the manufacturing of battery chargers in India which will not only boost the consumer durable industry but also produce thousands of job opportunities for the huge population of the employable resources. The market is ripe at this moment, due to which several investments are being done by the closing of the decade. In 2019, Nokia ventured in manufacturing smart TVs along with a partnership with Flipkart. Bosch Home Appliances invested US$ 111.96 million in the Indian market. Xiaomi became the largest offline brand network in India with its presence in over 800 cities. The consumer durable loan increased at a rate of 68.8% in this decade due to the growing necessity of the users. India is becoming more connected and urbanised and this will lead to a more glorified consumer durable sector.

As mentioned in my blog about the growth in the FMCG sector, the introduction of GST in 2017 has reduced the cost of the supply chain. This makes the situation favourable for the thriving consumer durable sector. Digitization and globalization are leading all the industrial sectors towards a brighter future, thus contributing to Shaping the Future of Work. The consumer durable industry is growing at a compound annual growth rate (CAGR) of 10%. With the rising disposable income, the demand growth is also accelerating, thus predicting a positive time for this sector. The digital platforms of shopping and the secured online payment structures also contribute to the development of this sector.

Wind-up

Since 2010, India can overcome the Great recession woes due to the overall growth across all the industrial sectors. Since 2010, the consumer durable industry has witnessed the optimum growth and it is still growing fast by the end of the decade as well. A single post cannot cover all the areas of the consumer durable sector. Do you want to know what else changed in these 10 years? Do you want to know what the road ahead looks like? You can get the answers from the experts hailing from the same sector. Talk to our niche skilled experts and veterans now to know the diverse competitive market in greater detail!

We at Vedak have an exclusive pool of experienced industry professionals and veterans who have in-depth knowledge in the consumer durable sector. Contact us to know more.