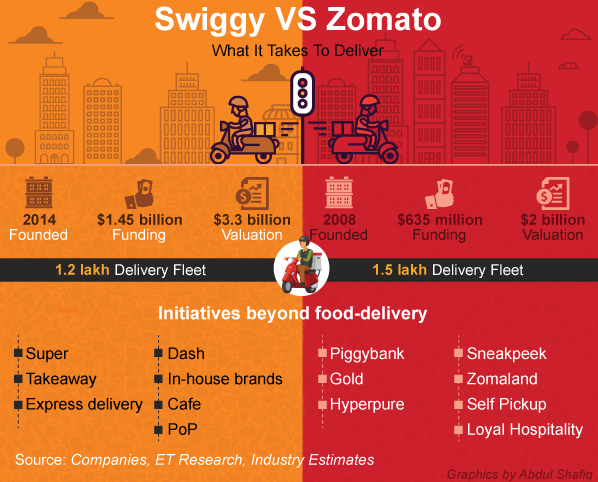

Taste and pocket pinch! These are the two most popular perspectives based on which the food apps and food delivering companies are functioning in India. The food apps have gained popularity among the masses. It is possible due to the convenience, flexible payment options and the hot meal from the favourite restaurants. Zomato, an Indian startup with Deepinder Goyal as the CEO, is the predecessor who entered the Indian market in 2008. Swiggy entered the field in 2014 with its CEO Sriharsha Majety, an alumnus of IIM Calcutta. Last but not the least, Uber Eats, founded in California in 2014, entered the Indian market in 2017.

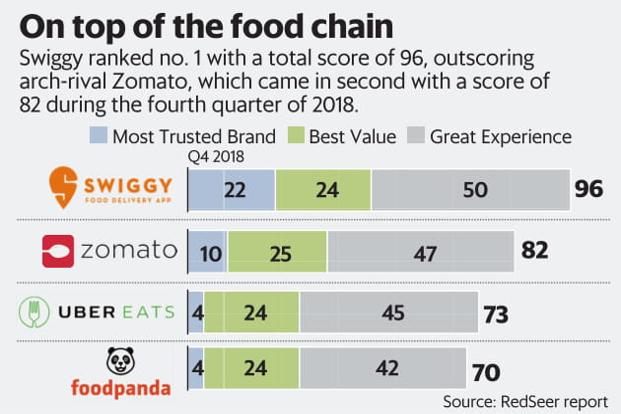

In this one decade, digitization, globalization and tech disruption reached the zenith, with a sharp increase of smartphone penetration. The food apps entered the market, but some could not sustain the neck-deep competition, for example, Foodpanda. In January 2020, Uber Eats was acquired by Alibaba-financed Zomato in an all-stock transaction, leaving its predecessors to rule the market. Swiggy and Zomato, both are dominating the market at present. Thus giving the food lovers a lot of options to choose from. Even though Swiggy entered the market after 6 years of Zomato’s reign, it has succeeded well in being a tough competitor of Zomato.

In 2019, Zomato was valued by HSBC at $3.6 billion, while Swiggy was valued at $3.3 billion. Though Swiggy did not get the advantage of the first-mover market, still it is catching up quite well. A report published by the Financial Express in 2019 said, “The positioning Zomato is looking at now is becoming more dominant in the South that they were missing earlier. South was all Swiggy while Uber was making some progress there. From an Uber perspective, this will still benefit them because they have not actually exited the market. They would want to get an upside based on an increase in valuation of Zomato.”

According to Kalaari Capital, “It is a good thing that the industry is consolidating. They have been burning money on every order primarily due to hyper-competition and aren’t charging for deliveries. These things are not sustainable. So consolidation gives you that pricing power. Customers will hopefully understand the value proposition and will pay for the delivery or buy without discounts.”

According to industry experts and analysts, Swiggy delivers 42 million orders a month, and for Zomato the number is 37 million. Swiggy was initially very successful in the Southern parts of the country. Since the 2018 campaign of Swiggy, it has gained momentum in the northern and eastern parts as well. The acquisition of UberEats by Zomato will help the latter to stand against Swiggy with renewed vigour. The food delivering segment of the ride-sharing services Ola and Uber faced severe cash burn, following by rolling back from the market. Ola’s Foodpanda and Uber’s Uber Eats decided to concentrate on their core business, that is the ride-sharing.

In 2018, Uber entered the New York Stock Exchange and also slashed the incentives of the employees. Uber’s performance in the stock market proved to be very disappointing. It posted the biggest first-day dollar loss in the US IPO history. Within just three years of entering the food delivery segment of the Indian market, Uber Eats realized its infancy is not suited for the cut-throat competition. Moreover, the poor performance of Uber Eats in India was affecting the global performance of Uber. So, the acquisition by Zomato seemed to be a suitable option for the time being.

Uber Eats retired from the market at a peak time. It is when the Indian food delivering sector is expected to touch 2.5 to 3.5 billion dollars by the end of 2021, as estimated by RedSeer Consulting. When Swiggy and Zomato were ranging between 35-45 million orders a month, Uber Eats was playing in a range of 12-13 million orders a month, as recorded in 2019. Uber Eats decision to leave the competition was a justified one; let us hope to see a profitable time for Uber, which is the ride-sharing service.

By the time Uber Eats entered the market, Swiggy and Zomato have tied up with all the major restaurants and popular chains of the regions. Uber Eats had to depend on discounts and offers solely for customer retention. In 2018, Swiggy and Zomato managed to bag huge funding rounds. This cushioned their star performance in the highly competitive market. All the three players more or less depended on discounts and offers, giving competitive rates. Thus they proved to be highly beneficial to the consumers.

Uber Eats depended on only discounts and Foodpanda tried to lure the consumers with Re 1 delivery charge. The element of repetitive purchase was missing, which is essential for business growth. Swiggy and Zomato paid attention to not only the discounts but also the delivery time and quality, quality of the foods, customer experiences and feedback, choice of restaurants etc. The competition in the sector of food apps is not an easy one to survive. Some survived, while others drowned.

As per a statement by a top official of Zomato in 2020, “With our expansion to 550+ cities over the last year, our continued focus on user experience and our commitment to operating excellence, we have demonstrated our ability to execute on a variety of parameters.”

While the main objective of Uber Eats was customer acquisition, Swiggy and Zomato thrived for customer retention. The food delivering platforms have developed UX/UI strategically. One can check the ratings of the restaurants, locate and contact the delivery executive, see the time required to receive the delivery, and can track locations. When needed the consumers can contact customer care for any issue like not receiving the delivery or queries about payments and order cancellation etc. On these platforms, the restaurants can register easily after proving authenticity through proper documentation. The restaurants and the apps are in sync regarding every order placed and every transaction made.

As the picture of food apps of 2019 suggests, Swiggy is operating in 500 cities in India with 40,000 restaurants tied up with its arm. While Zomato is operating in 24 countries of the world and 10,000 cities altogether. With such a stark difference in their network, the monthly order of Swiggy is higher than Zomato in India, as already stated earlier! The customers can choose, as per their preference, from the options of several food delivering companies given by these two major players, Zomato and Swiggy. The competition between these two players shall continue in the coming years, giving benefits to the huge customer base. Uber Eats, though existed for a few years, was nowhere near these two giants in the Food-tech sector.