The automotive sector around the world is undergoing a roller coaster ride due to the fast-paced technological disruption. Disruption is a very interesting and unpredicted phenomenon and no industry has escaped from its grip. The automobile industry is progressing towards driverless cars in the face of disruption. The market of the connected car is growing at a 5-year CAGR of 45%. It is ten times faster than the general automotive sector. It is predicted that by 2020, 75% automobiles will be equipped with internet-enabled hardware.

In the former half of the decade, the navigation control system used to be just another component used by OEMs to track the third party vendors. But, now, with the arrival of technological advances and innovations, the non-traditional suppliers like Sharp, Google (Android Auto), Apple etc impacts the overall value addition to the diverse automotive sector. Thus improving the usability and performance standards of the ‘new-age car’.

As reported by Infosys, “According to IHS, 10-25% of the cost of making cars and light trucks is now linked to the software. Just as non-traditional enterprises revolutionized the smartphone market, they will also disrupt the automotive market. Jen-Hsun Huang, the chief executive of chipmaker Nvidia Corp, predicts that a disruption, similar to the one of the smartphone, will take place with the car, which will transform into a delightful computer rolling down the street.”

Automation in Automotive Sector

The global economies are in a state of continuous flux. Changes are driven by the development of the emerging markets, technology penetration, sustainability policies, and shifting of the preferences of the new-age consumers. Digitization and Automation have transformed several industries like Healthcare, Education, Finance etc, and automotive is no exception.

The modern age innovations have impacted and brought forth some major changes in domains like connectivity, electrification, autonomous driving and diverse mobility. Many industry experts and analysts opine that the automotive sector is ripe to embrace technological disruptions. Some imminent changes that are on the horizon due to disruptions can be prominent in certain segments. For Instance suppliers, traditional manufacturers, consumers, markets, new players and automotive value chain.

Gabriel Seibert, the MD of Accenture Digital said, “It means we’re not marketing to sell a product anymore.” He also added that “We’re marketing to demonstrate an experience that goes far beyond the traditional point of purchase. And it may be that this experience is one where there is no ownership involved and, instead, it’s about shared models and mobility as a service, rather than mobility as a product.”

Technological disruption has affected product quality and performance, keeping the brand’s identity consistent throughout. Joger Poggenpohl, the global head of digital marketing at BMW believes that “We see ourselves as leading shapers of the future of mobility. Autonomous, electrified and connected driving as well as new and innovative mobility services will be the major topics. But, the promises of the BMW brand will remain unchanged. BMW stands for pioneering innovations, aesthetic design and a premium approach.” BMW is a premium car manufacturer. It incorporates newer features in its models. But the brand identity is unchanged, rather it is even stronger than before.

Tech Disruptions and Emerging Consumers

The most important metamorphosis that is visible is the shifting notions of technologically disrupted consumers. The automotive sector is embracing the disruptions and manufacturing new-age cars, but all these efforts for whom? The consumers. Previously, the car used to be not just an efficient and comfortable mode of commute, but also a status symbol. The consumers mostly hailing from the metro cities were inclined to purchase a vehicle, keeping in mind their social image.

At the beginning of the decade, Tata Nano was launched. But the cost-sensitive consumers of India were not ready to be pictured as “owner of the cheapest car”. The initiative of salt to software conglomerate Tata became a massive failure within no time.

The consumer is the king, and all the efforts are to make him happy. Then digitization dawned and the consumers evolved with time. Now, they want seamless experiences and efficient methods in their lives. Besides being a status symbol, the cars also became efficient modes of transport; credit goes to the rising ride-sharing services, like Ola and Uber.

The consumers now have, what is called, “Amazon effect”. They expect to get the required products easily just like in Amazon. Whether they want to buy a kg of rice or a commute or purchase a car, they want seamless experiences. The new entrants in the auto tech sector are the ride-sharing services, targeting user experience of a busy life.

The consumers can enjoy the comfort of an air-conditioned sedan via Ola and Uber without purchasing one. There will be no tension of loans, no fear of tax, no fear of insurance or damage. Easy efficient commute, cost-effective services, and easy process to book one, all these features make the ride-sharing services very popular among the masses. Download the app and book can easily. Along with these, there are platforms, for second-hand cars. One can register and buy one easily. The modern age consumers want everything easily; their expectations cushioned are by the overwhelming smartphone penetration.

In the 1980s, the Japanese automobile manufacturers anticipated the US demand for fuel-efficient cars. And they launched the same predicting the growing market. The software companies like Google and Apple have the potential of making the OEMs as mere assemblers of cars or simply hardware makers. They have the ability to build their identity in the diverse automotive sector. The CEO of Apple, Tim Cook said that “the automotive industry is ripe for a massive change, with new software, electric motors, and self-driving capability becoming much more important in a huge way.”

Collaborations and New-Age Cars

Some recent announcements of collaborations and partnerships are on the news. This is denoting how the automotive sector is actually gearing up for embracing the rising tide of technological disruptions. “Germany’s BMW and Daimler have teamed up to develop autonomous vehicles, while also announcing new lines of electric models. Volkswagen has announced a similar alliance with Ford, confirming its intention to launch a transport service with fully electric vehicles this year and breaking a 20-year hill climb record with its I.D. R electric racing car, while Ford is pressing ahead with Argo, its autonomous vehicles division.”

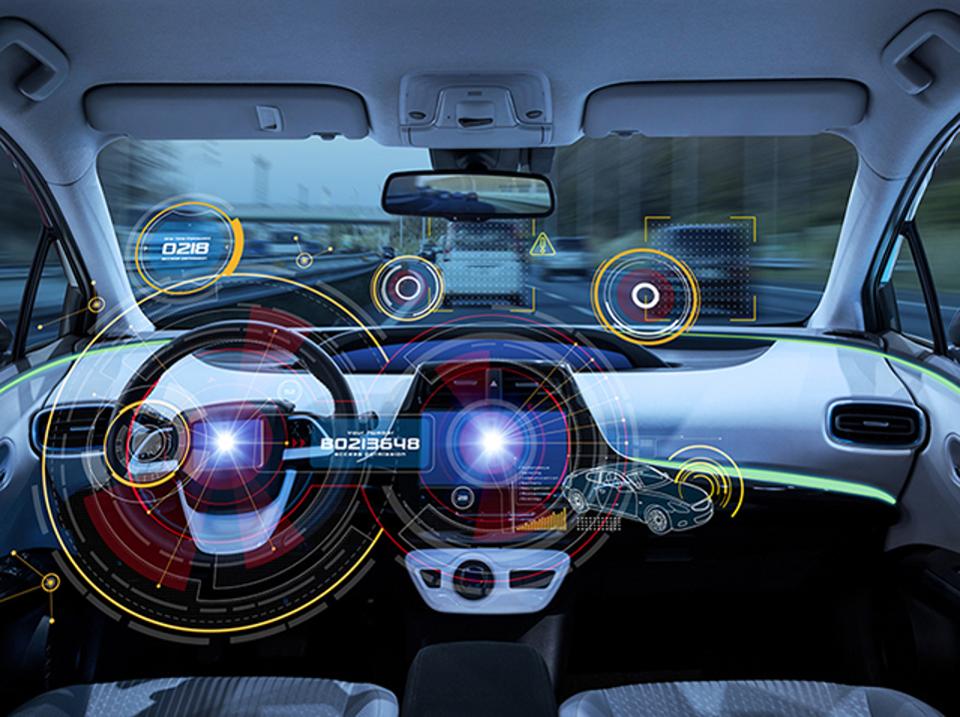

The technology is uniting with the automotive sector. It is imperative to know that driverless cars have caused major hype around the world. The automobile will be endowed with an Advanced Driver Assistance System (ADAS), 360-degree scanning sensors, vehicle to vehicle (V2V) communication system and vehicle to environment (V2E) communication system.

The driverless car is at its infant stage as of now, and available at sky-touching prices. The driverless car is expected to be available in lower price brackets in future. The price of the control software system of Mercedes Benz S550 is $23, 000. This is actually the price of a medium-size car approximately. It is estimated that within the next ten years, the software system of the car can be as low as $5500.

In-depth knowledge of mechanical engineering and technical engineering is imperial for the manufacturing of smart cars. The Machine Learning required to analyse various data and situations to adapt to the conditions of the road ahead. Such expertise is much more available to Google and Apple in comparison to the traditional OEMs. The OEMs have the chances to encounter the scenario faced by Kodak. Kodak chose to ignore the technological disruptions thus heralding its own downfall. Productive and profitable collaborations between traditional OEMs and software firms will enable the manufacturing of new-age cars. Thus shaping the Future of Automotive.

As reported by McKinsey, “software competence is increasingly becoming one of the most important differentiating factors for the industry, for various domain areas, including ADAS/active safety, connectivity, and infotainment. Further on, as cars are increasingly integrated into the connected world, automakers will have no choice but to participate in the new mobility ecosystems that emerge as a result of technological and consumer trends.”

Conclusion

The increasing emphasis on education, per capita income has driven the penetration of cars among Indian cross-sections. Automobile penetration is taking place all over the world. It has contributed to rising global warming, pollution levels, greenhouse gasses and other such harmful effects on the natural ecosystem. The stricter regulations and pollution control policies have helped the electric vehicles to gain momentum in the coming years. The pace in which the electric vehicles will be adopted will depend on the consumer pull and regulatory measures. It may differ in varying regional and local levels.

The traditional automotive players need to get ready for the waves of uncertainty brought by the technological disruptions. Exploring alternatives, consumer viability and mobility business models will help the OEMs to sustain the cut-throat competition of the automotive market landscape. The automotive players need to focus on not just the mechanical and technical details. But also cybersecurity, data privacy, software-enabled consumer value addition and frequent product updates. This will ensure them to retain a profitable share in the growing global automotive market revenue and the profit pool.