Technological disruptions have crawled in almost all the industrial sectors, and Insurtech is no exception. The Digital Revolution has brought in a metamorphosis in our daily life, work and how are engage and interact with others. Just like, wealthtech, fintech, Edtech and health tech, Insurtech has gained momentum in recent years in India. It prioritizes the customer experience and the product portfolio. Insurtech has already started disrupting the traditional value-chain in India to improve the digital distribution and customer satisfaction. India is on the go to secure a strong position in the Insurtech 100 globally, with its digital platforms and innovative approach. The first digital general insurance company Acko was founded in 2017, marking the beginning of Insurtech revolution in India.

Digital Revolution Shaping Insurtech

Several insurance companies in the world have revealed their anxiety and insecurity. They believe that a large segment of their business can be passed on the Insurtech startups that are more agile and tech-savvy. The lion’s share of the Insurance sector still now relies on paperwork and documentation. The traditional incumbents focus on employees rather than on customer needs.

The traditional method of the insurance business is all geared for a transformation with strategic product launches and the inclusion of the Insurtech in the Indian ecosystem. The new breeds of companies are eager to take up the challenge and apply an innovative approach for the Future of Insurance sector.

As per a report published by PwC, digitization can slash off 15-20% of the total cost of life insurance. This will enable the life insurers to penetrate beyond the domestic bounds and tap the new customer segments of the global space. Insurtech is endowed with great potentials to enhance the customer experience in quicker turnaround time (TAT). The Indian insurance segment is up for quite a major shift, bringing the infant Insurtech to the front and forcing the traditional insurance companies to take a back seat.

As per the above-mentioned report, “The insurance industry in India is going through a fundamental shift. Rising awareness, accessibility, affordability, regulatory reforms and economic growth are some of the key factors impacting the industry. For some insurers, it is a phase of re-establishment and keeping themselves relevant. For others, dealing with these disruptors is critical to their survival. The government’s decision to permit 49% foreign direct investment has made the Indian insurance sector lucrative to foreign investors and enabled insurers to secure capital to work on aggressive plans related to expansion and innovation. Further, insurers who have been in business for at least 10 years are allowed to raise capital through initial public offerings (IPOs).”

Insurance Sector Expanding

According to the India Brand Equity Foundation, insurance penetration in India was merely 3.7% in 2017. There is a universal belief that the simplified selling of insurance products on digital platforms can enable a greater percentage of the unexplored population to buy the products seamlessly. The procedure will look like buying products from eCommerce platforms like Amazon and Flipkart.

With increasing internet connectivity the Insurtech is ready to nurture the technology-led companies with online platforms. The innovative customized products are made suitable for the needs of the diverse user base of the country. Many insurance companies want to own startups with a 100% stake in companies and not just 10% cap as ordered by the regulator.

The CEO of Max Life Insurance, Prashant Tripathy said, “We, as an industry, have made a presentation to IRDAI to allow us to own 100% in these companies.” He also added, “We want to buy all 100% in InsurTech companies, which align with our business.”

As reported by the Economic Times, “Companies in the insurance innovation space are focused on building digital platforms, which are aggregators and Robo advisors using machine learning and usage-based selling. Insurers are using technology that aids fraud detection at the point of underwriting and also for assessing risk — for example, the use of wearables in the context of ‘diagnostics’ for better underwriting. There are a dozen insurance aggregators that help customers compare policy features and assist in buying. Others use sensors that stick to the skin and are used for fitness monitoring, glucose level monitoring to track health”

Technology in Insurance

The inclusion of technology in the Indian Insurance segment has been promising and paved a definite path for unleashing the future growth. The Internet of Things (IoT) has enhanced the capabilities of the Insurtech companies by providing a sensor-enabled global network. The operations are carried out by connected devices.

Blockchain technology is an integral part of the Insurtech. It helps in bringing all the information in one common platform and making the quoting and claiming process seamless. The data can be accessed by all but changed by none.

The modern-day insurers have identified the power of Analytics for enhancing value addition, growth and optimization and also trigger value-driven decision making. The predictive analytics can be used by the insurers to get a better understanding of the customer needs and the changing market dynamics. Artificial Intelligence (AI) is playing a crucial role in the evolution process of Insurtech.

PNB MetLife has entered into a collaboration with LumenLab to launch the AI-enabled customer service app “KhUshi”. The chatbots installed in the app can interact with new and existing customers regarding any insurance related queries and solve their problems faster.

A virtual reality app “conVRse” is also included by the MetLife targeted towards the customer needs and satisfaction. Robotics are used to simplify the day to day processes like issuing auto-debit receipts and thus reduce cost and TAT. As opined by the CIO of PNB MetLife Samrat Das, “All our technological innovations are guided by our two core values – ‘Make Things Easier’ and ‘Put Customer First’.”

Booming Insurtech Startups

In India, the Insurtech sector is dominated by names like Acko, Artivatic, Mantra Labs, Pentation Analytics, PolicyBazaar, Digit Insurance and Coverfox. There are many more in this sector, though this sector is at a young stage, still, it has made some notable contributions in the disruptive Indian landscape. Acko uses deep data analytics for providing personalized pricing to its customers. It analyzes the behaviour and the interaction pattern of the customers before suggesting them the suitable options.

In recent years, Acko has provided insurance cover to 40 million Indians, and acquired 8% in the car insurance segment purchased online in India. Acko has also launched Ola Ride Insurance Service, for lost baggage, laptops, missed flights, medical requirements, ambulance transportation cover etc.

Artivatic is quite a prominent name in this sector, with its clients including KPMG, Deloitte, HCL etc. Artivatic provides Software as a service (SaaS) platform for the automation process of buyer onboarding, claim administration, customer profiling etc. Mantra Lab is another AI-based platform providing digital solutions to the Insurers solving the front and back-office challenges. Pentation Analytics has come up with ‘Insurance Analytics Suite’ which, with the help of Machine Learning, addresses issues like underwriting, acquisitions, retention, and cross-sell etc.

PolicyBazaar is the largest insurance market place in India. Here, the customers can compare various products, their prices before investing in any particular plan. The customers can choose from a range of products as per their preference, they can buy, sell or store products online. The platform also provides end-to-end solutions for claim assistance and tracking policies. With 100 million users annually, and covering 32% of India’s insurance cover in retail and health business, PolicyBazaar has given shape to the Insurtech segment of the nation.

The Mumbai-based startup Coverfox has more than 150 policies in moto, health and life insurance. It has plans to expand in tier II and III cities and diversify the product portfolio for targeting the women’s needs. Its Android app, Coverdrive helps the insurance agents to grow their business digitally.

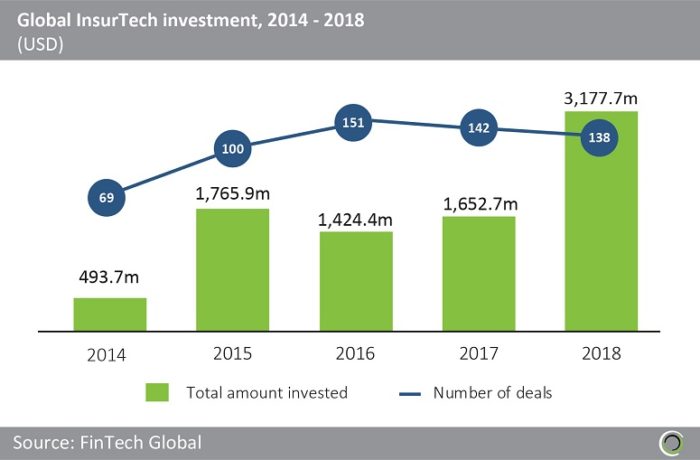

As reported by Fintech Global, the capital invested in the Insurtech startups reached $3.18 billion in 2018, which is much higher than $1.65 billion in 2017. The venture investors have identified the potential of the Insurtech startups, and are allocating large amounts driving the growth in this sector. The traditional insurance companies who have been working in legacy software, are eager to collaborate with the tech-enabled Insurtech startups.

Wrap Up

The changing habits of the users, their lifestyle habits, the increase in literacy and per capita income, smartphone and internet penetration have cushioned the growth of the Insurtech sector in India. By the time the online insurance platforms are launched, the users are well accustomed with the eCommerce platforms. They are well acquainted with the convenience and seamless experiences. When they found that for insurance also there are online platforms, they did not delay in lending their trust on these Insurtech startups.

The modern-day customers do not visit the government offices for enquiring about their policies, health insurance, life insurance etc. They seek the answer on the Internet and the digital solution is just something they need the most. Finding all the answers by just one click is what they need, and the same is provided by the Insurtech startups.