The son had to send the money for his mother’s treatment urgently to his father staying in his native village. But it was a Sunday, all the banks were closed, how would he do the needful? Had it been in the 1990s, it would have been a worrisome situation. But now, the son transferred the money via Google Pay and the father’s bank account was credited within minutes. The Fintech has aimed to make the lives of the common men easier and convenient. Digitization, technological disruptions and the evolving online payment platforms are growth drivers for this sector.

Previously, the people had to stand in the long queues for updating bank passbooks, withdrawals, and other bank functions. But now, the banks like State Bank of India, ICICI Bank, HDFC Bank, Bank of Baroda etc have their e-corners. There the people can perform several functions themselves via machines, without standing in the tiring long queues. The automation has penetrated in the financial sectors, just like any other sectors like Information Technology (IT), Healthcare, Education etc. The smartphone penetration and the availability of the affordable data charges have triggered the growth trajectory across diverse industrial cross-sections.

According to Accenture, India is the third-largest fintech centre in the world and has also emerged as the most profitable investment spot for major markets, as of 2019. In 2018, the investment in Fintech sector was $1.9 billion. In 2019 the number has almost doubled and touched $3.7 billion. The number shows promising for this sector and India has thus bagged the third position after USA and UK.

According to data of CB Insights, the investment in the sector almost tripled, from $660 million in 2018 to $2.1 billion in 2019. The investment in Insuretech has skyrocketed to 74% and reached $510 million. The MD of Accenture India Financial Services, Sonali Kulkarni said, “There’s a lot of brewing in India’s fintech ecosystem and this steady flow of funds shows investors’ confidence in the industry’s future growth potential. The increase both in deal value and number of deals is a good indicator of what’s to come and bodes well for the future development of cutting-edge financial technology in India.”

Scope of Investments in Fintech

The major investment in the fintech segment is shared by the payment start-ups which accounts for about 58% share. Insuretech bagged 13.7% of the investment, fintech in lending stood at 10.8% of the total investment. In 2019, PhonePe raised $210 million, RazorPay raised $75 million, Policybazaar bagged $282 million and credit card payment company CRED acquired $120 million in term of investments.

In the World Economic Forum of 2020, the CEO of Naspers Bob Van Dijk expresses his optimism about the growing fintech sector of India. He opined that the Indian venture capital fund will double its investments in the start-up ecosystem, aided by the new-age financial products.

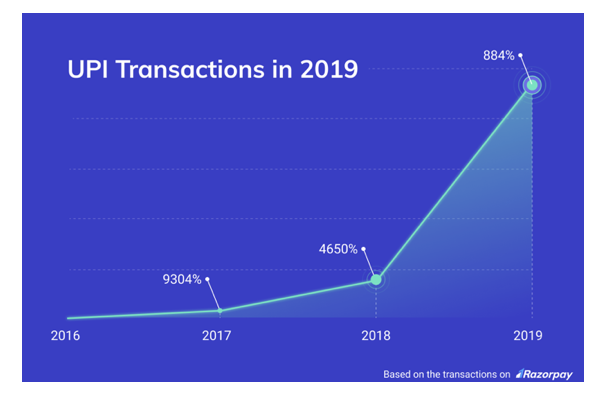

The sudden demonetization of 2016 has sparked the nation to incline towards the cashless transactions brought forth by the payment start-ups. Paytm witnessed a surge in transactions due to the inconvenience caused by the overnight banning of the highest denominations currency notes. After 4 years, the nationwide lockdown to contain the transmission of the pandemic coronavirus has urged the users to go for cashless and no-contact transactions.

The payment platforms like Paytm, Google Pay, BHIM UPI, PayPal etc are observing huge credits and a spike in their number of users. More and more people are using the apps and carrying out their daily transactions. Even the smallest shops and Kirana stores have Paytm and Google Pay QR codes for convenient cashless transactions. National Payment Corporation of India (NPCI) has announced that Indian citizens must use digital payments to reduce social contact and prevent the transmission of disease.

The MD and CEO of NPCI Mr Dilip Asbe said, “In the current lock-down situation, we request citizens to stay at home. We urge all service providers of essential services and consumers to switch to digital payments methods to stay protected.” He also added, “Our business continuity plan is resilient and has been improvised to meet the challenging requirements for COVID19, across all our payment systems. Specifically, the infrastructure will support the additional load and challenges on the United Payments Interface (UPI) platform, as more and more users are tapping into the benefits, ease and safety of digital transactions.”

For vendors and merchants, NPCI and the Indian government have taken prompt actions to onboard them easily on the online payment platforms. Asbe added saying that, “For vendors and merchants, we have fast-tracked the onboarding system on UPI or UPI-QR to make it totally contactless and fully online. Vendors do not have to compromise on self-isolation guidelines to complete this essential task. Vendors and merchants can be safe as they serve society and provide essential services. Consumers can use UPI to pay for essential services and transfer money digitally without the risk of physical contact.”

Going Cashless Contributing in Fintech

Juniper Research reported that by 2024 the value of global eRetail transaction will reach $4.8 trillion, increasing from $3.3 trillion in 2020. The outbreak of the coronavirus infection has hit hard the business and governments globally. The transforming market dynamics is posing as a formidable challenge to the fintech firms and the lending platforms.

The COVID-19 has resulted in an unprecedented situation globally. The contagion is affecting the fintech in filling the credit gap that was left unnoticed by the traditional banks. While sectors like food and consumer goods are witnessing a hike due to the rising panic buyers, several industrial segments are incurring humongous losses. Visa and MasterCard have alarmed the shareholders regarding a nosedive in travel-related expenditures, slashing their deals by 2-4%.

The worrisome situation can compel the early-stage start-ups to have their shutters down. Although the contagion has increased the dependency on the Fintech, the chances of investment freeze loom large on the infant startup ecosystem. As reported by The Financial Brand, some young fintech firms and also the existing ones can be affected by the insufficient venture capital (VC) funding. In this dark scenario, the fintech firms are well equipped with their digital channels to serve the users globally as well as in India.

The co-founder of Columbian lending fintech firm Linxe, Cesar Cuevas thinks that the outbreak of COVID-19 is actually a blessing in disguise for the fintech firms globally. It is due to the fast-paced adoption of digital banking services globally. The people are now dependant on net banking and mobile banking apps more than ever. The legacy banks that are yet to launch their digital presence will make the most use of the current situation and contribute to the growth of the Fintech segment.

As per a study of NASSCOM and KPMG India, “A wide gamut of fintech sub-sectors has emerged and has been adopted by key players of the financial sector globally. The Indian financial services sector has embarked upon its digital journey and is catching up fast with its global peers in terms of adoption. Multiple fintech hubs have evolved across the globe ―the U.S., the U.K., Israel, Singapore, Hong Kong and Sydney to name a few ―which may well serve as a yardstick of fintech evolution for the emerging markets.”

As reported by Invest India (National Investment Promotion and Facilitation Agency) India has the highest fintech adoption rate in the world of 87% which is much higher than the global average rate of 64%. By 2023, the Indian fintech segment is expected to grow at CAGR of 20%. The future shows promising for the sectors and also its subsectors like wealthtech, Insuretech etc.

Applications of Fintech in Various Sectors

In consumer credit segment, the urban population is inclined towards the Fintech services to avoid the travails of heavy documentation; whereas the rural population can draw the benefit from the alternate credit scoring mechanisms and relieve the pressures of the loans. The Internet of Things (IoT) is used in Insuretech primarily for telematics and risk assessment. At present, there are over 100 Insuretech firms operating in India.

Some of the major growth drivers for the Fintech sector can be:

- the widespread formalization of identity, like the Adhar enrolment,

- the government initiative of banking penetration like Jan Dhan Yojna,

- smartphone and internet penetration,

- increase in literacy and per capita income,

- initiatives like UPI and Digital India,

- rising middle-class expansion etc.

The Bank of International Settlement (BIS) published a paper titled The Design of Digital Financial Infrastructure: Lessons from India, where it said, “Key features of digital finance include the ability to use mobile devices, quickly authenticate identity, and real-time payment services. Their scalability means that they can be applied to hundreds of millions of customers, even for low-value transactions. Such low-cost, high-volume, low-value digital financial transactions were unimaginable a decade ago.” The Reserve Bank of India (RBI) and Securities Exchange Board of India (SEBI) have played a crucial role in incorporating technology within the financial services.

The co-founder of Flipkart Sachin Bansal’s Navi Technologies has taken some crucial steps by acquiring NBFCs for providing rural credit and create a space in the insurance sector. Bansal’s company Chaitanya India Fin Credit has applied for a banking license recently. THE Chairman of Infosys Nandan Nilekani said, “India will be the first country in the world where individuals will be empowered to use their own data.”

Conclusion

The leading fintech companies that are major players in the sectors are Paytm, PayPal, PhonePe, Google Pay, trading companies like Share Khan, Money Control, insurance companies like Policybazaar and also Bankbazaar. The crowdfunding and equity funding services are also gaining momentum in India in recent years, after the USA and UK. The growth potential of crowdfunding in global fintech can be estimated to $16.2 billion.

Cryptocurrency is also growing in India, but it is at a young stage as of now. The correct business acumen in finance and app development can lead to some very profitable investments. Fintech is one of the most promising and growing sectors in India, which gives a lot of scope for reaping the maximum benefits. The immense growth potential of this sector is absolutely in sync with the disruptive technology of the modern world.