The homegrown mobile brand Micromax started winning the market since Rahul Sharma started the company in 2000 in Gurugram. But since 2017, the place of Micromax has been unstable with a sharp decline in the revenue. The Chinese market has attracted the attention of Indian customers like no other brands. The brands like Xiaomi, Oppo, Vivo are meeting the rising demands of the new-age customers, and Micromax just lagged behind. In 2016, its revenue touched Rs 10,000 crores mark. In 2017 the value declined to Rs 5,614 crores, and in 2018 it plummeted to Rs 4,430 crores. The company witnessed a sharp fall of 74%, hinting at the critical financial health of this mobile phone brand.

In the initial days, Micromax dazzled the vast and diverse cost-sensitive user base with its innovative and user-friendly features. For the Indian consumers, the range between Rs 5,000 to 10,000 is considered to be the sweet spot which is aimed by the rising brand. In 2012, when the average phone that was available to the Asia Pacific was in the price range of $200-$300, Micromax launched the legendary Canvas 2 A110, the first dual-core smartphone.

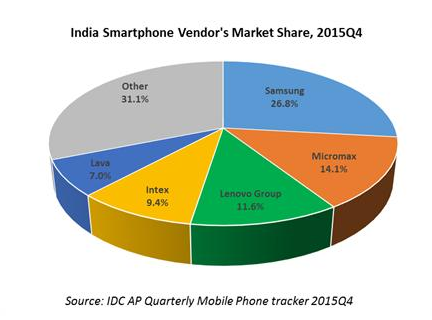

Micromax managed to limit the price within $150, thus gaining the limelight among the domestic users. In 2014, Micromax reached its zenith with 22% market share and launching of several models under the Canvas series. Micromax imported the handsets manufactured in China, resulting in producing budgeted mobile phones. The second place in the Indian market is captured by Samsung, which was dwindling in this heavy storm of Micromax.

Micromax not only attracted the attention of the Indian users but also the Chinese innovators and Original Equipment Manufacturers (OEMs). Micromax did not gauge the inclement weather that was looming large on them. In 2013 alone, 41 million phones were shipped under this name, and in 2015 it showed a gigantic leap of 32% with the number increasing to 95 million. Since 2017, the number has decreased drastically. There are major reasons behind it from which the budding entrepreneurs and business owners can learn a great deal. Let us dig a bit deeper than to know the downhill journey of this popular mobile brand.

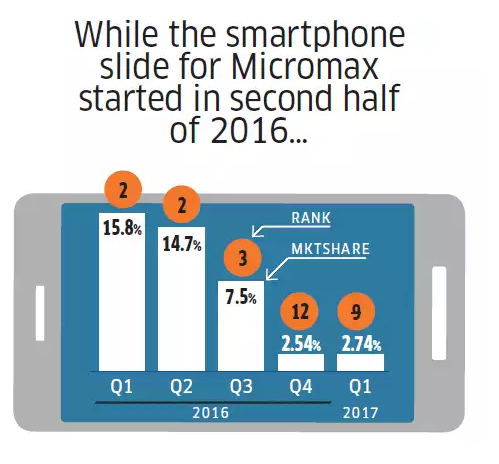

The technical incompetence, just like the Nokia, or the faulty marketing techniques like that of Nano, is not blamed by the experts and analysts. The sudden surge of 4G and demonetization contributed to the sluggish growth of Micromax. The entrance of Chinese brands like Xiaomi and Oppo affected the sale of Micromax. But the factors that are majorly responsible for adversely affecting the brand can be categorised under four heads.

Firstly, the maximum of the phones manufactured by the Micromax is 3G enabled. The users were satisfied with the speed and the efficiency of the mobile brands. 3G was launched in India in 2008 and 4G in 2012. But the internet charges were very expensive compared to 3G, which helped the brand to sustain this new change. 75% of the phones were suitable with 3G and people were reluctant to shift to 4G due to the tariff. In 2016, Reliance Jio launched 4G at much cheaper rates, compared to its competitors Vodafone and AirTel. This triggered the Indian mass to enjoy the faster speed at a limited pocket pinch. Since the Micromax could not satisfy the demand of the sudden 4G enthusiasts. It lagged behind, giving way to its Chinese competitors like Xiaomi and Oppo.

Secondly, in 2016, the Modi government banned the Indian currency notes bearing the highest denominations. The overnight decision of Demonetization affected several industries and businesses like automotive, FMCG etc. The cash purchase of the Micromax phones ranging between Rs 5,000 to 10,000 decreased drastically, hitting the sales hard. Micromax targeted the sweet spot as mentioned above, but did not apprehend that the Indian users can shell extra for purchasing better phones at a little higher range as well. Sticking to a particular bracket weighed heavy for the brand Micromax.

Thirdly, Micromax launched similar models in similar price ranges in bulk. The multiple handsets launched all at one go did not prove to be profitable for this domestic brand. While the competitors were launching fewer phones in a single price bracket, and creating a buzz for other upcoming models with updated features and higher price bands, Micromax was not doing that. Micromax spent a fortune on promotions, teaming up with celebs like Anil Kapoor and Hugh Jackman. But, all these did not help it to retain its throne. Due to the concentration on one segment, Micromax unknowingly opened avenues for its competitors to capture the market between the price ranges of above Rs 10,000.

The Indian users by this time are comfortable with eCommerce platforms and their gadget obsession is moving north. Xiaomi and Oppo are giving updated versions of cameras and processors, 4G features and at a little bit higher range and that is fine with the users, especially of the tier-1 and tier-II cities. Spending Rs 5,000 more for a better experience became the primary focus of emerging new-age consumers. According to the head of Intelligence of CyberMedia Research, “Micromax failed to grasp the fundamental market shifts in the India handset market. The failure to grasp changing market realities and consumer expectations meant a rapid erosion of market share for the likes of Micromax.”

Last but not the least, Micromax made certain poor decisions and the internal turbulence just added the cherry on top. In 2015, Alibaba backed out of the deal of purchasing 20% share in Micromax for $1.2 billion. Micromax made certain efforts like hiring new executives for reforming and re-imagining the business models and strategies. But this step backfired as there was a turmoil between the founders and the executives.

The CEOs of the company like Sanjay Kapoor and Vineet Taneja resigned, hampering fast and efficient decision making. Due to the internal turbulence among the C-suite of the organization, it missed bagging the $1 billion investment of SoftBank, Japan. The lack of funding and effective business strategies made it defenceless against its competitors. Micromax’s plan of starting R&D centre was also incomplete, due to the lack of investments. In 2014, Micromax launched Yu in a joint venture with Cyanogen Inc and launched budgeted phones. But this step did not bear many fruits.

The changing era demands diversification for the survival of any business. Just like Fuji Film, Samsung entered in various other segments to capture more shelf space, like TV, Tablets, fridge, AC, desktops etc. Micromax must adopt such a diversified approach to attract the users once again. The lack of homegrown manufacturing facility of Micromax can be another reason behind its failure. But, Micromax has chances to turn around as the smartphone business is not going anywhere anytime soon. There are avenues still open for innovations and harnessing the demands of the vast user

From the situation of Micromax, there is a great deal to learn.

- Short-sightedness is harmful to business growth: Micromax lacked insight and concentrated only on the cheaper models. Even though the majority of the country is a rural sector, still the sales of smartphones are primarily observed in the urban and semi-urban centres. Micromax already positioned itself as the manufacturer of cheaper phones. So why would the users invest in the same brand for the more expensive ones? Xiaomi has launched smartphones covering a wide range, OnePlus is on a much higher side but it has its own target users. Micromax, just like Nano, emphasised on providing cheaper products.

- Transparency in the organization is essential: Micromax decided to hire new executive and officials, but they were not able to see eye to eye, forget any communication. Top-level executives and CEOs resigning just when the company needed their advice the most hint at larger turbulence at play. Transparent communications and collaborative approach is essential for any business expansion.

- Self Dependence is the pillar of strength: Micromax is dependent on OEMs for manufacturing its phones. The Chinese manufactures have seen the prospects of the Indian market, then why would they enter the market via Micromax? Micromax did not have any indigenous manufacturing facility and it was solely depending on the imported Chinese handsets. This proved to be a blunder in the long run.

This decade has seen several changes in the market conditions and rise and downfall of many business ventures like Tata Nano, Indiaplaza. The rise of the gig economy and soloprenuers is going on in full swing, and this competitive and crowded market can be a challenge for your growing business. You want to avoid such mistakes, but who can guide you? Google will give you hundreds of websites, but an expert will guide you thoroughly in your journey. Do you want to talk to experts in detail? Talk to our niche skilled experts now to know the diverse competitive market in greater detail! We at Vedak have an exclusive pool of experienced industry professionals and veterans who have in-depth knowledge about the business nitty-gritty. Contact us to know more.